1. Help determine the most tax-effective way to get the money out of super

Clients under 60 years old need to carefully consider how they will withdraw funds from super once a TPD claim has been paid to their superannuation. There are two choices: lump sum commutation or pension payments. Depending on their circumstances, the tax consequences can vary dramatically.

Each form of payment is entitled to special tax concessions:

- Lump sum commutations result in a ‘tax-free uplift’ calculation which increase the proportion of any withdrawal that is tax-free

- Pension payments are taxed at marginal tax-rates but receive a 15% tax offset on the ‘taxable’ component of super. The ‘tax-free’ portion of super can be paid tax-free.

As an example, a client of ours on a TPD claim wanted to withdraw enough from superannuation to clear their mortgage. The total withdrawal required was $637,443. The tax consequences were as follows:

- Lump sum: $444,522 could be withdrawn tax-free and the remainder was subject to 22% tax (including Medicare levy) which would result in a personal tax liability of $42,443

- Pension payment: The full payment would be taxable at their marginal tax rate subject to a 15% tax offset which would result in a personal tax liability of $174,649

In this case, the wrong option could have cost the client an additional $132,206 in unnecessary tax.

Each option has different pros and cons and it’s important to evaluate each client’s unique circumstances to ensure the most appropriate option is utilised.

2. Conduct a longevity analysis to provide the client with a better understand of how long their money will last depending on how much they spend and how they invest

This is the part that helps a client sleep at night. With the client, we go through and review their priorities this is typically a combination of clearing debt and ensuring the have enough money each year to live on but other things could be included as well.

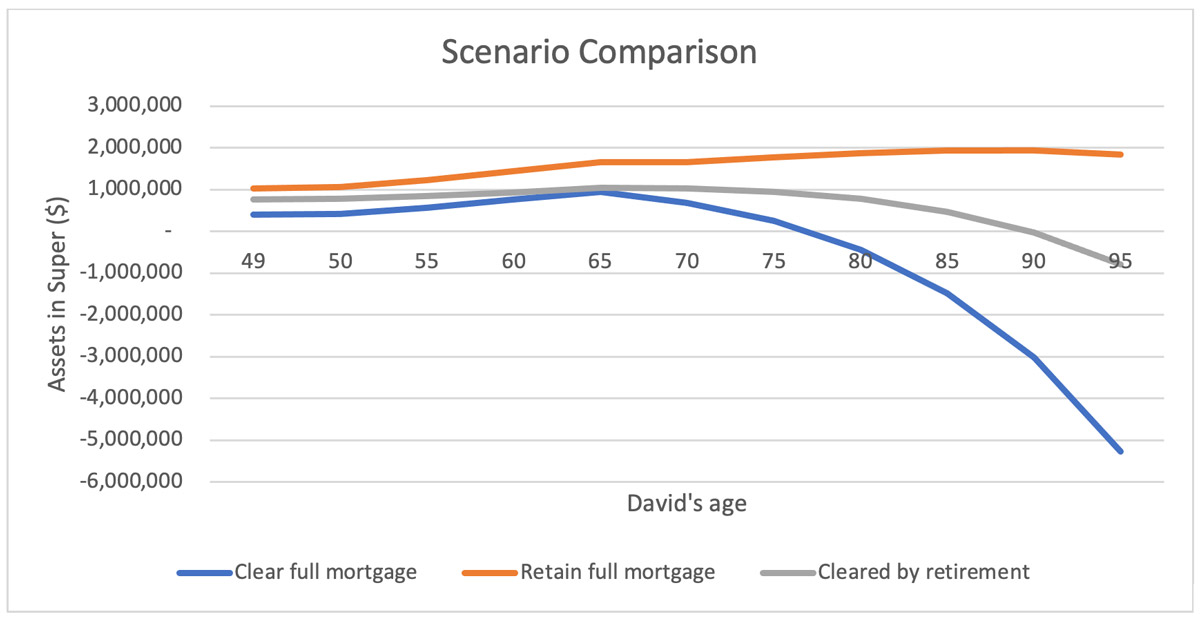

Using the client from the above scenario, we reviewed a few different scenarios to help determine if just clearing the mortgage was the best idea. Keep in mind, the client that receive the TPD has a partner that was still working and ‘retirement’ refers to the working partner.

| Scenario | 1 – full mortgage payout | 2 – no mortgage payout | 3 – mortgage free retirement |

| Super withdrawal | $637,443 | $20,000 | $262,476 |

| Super balance | $377,862 | $995,305 | $752,829 |

| Mortgage balance | $0 | $580,000 | $350,000 |

| Age when super runs out | 78 | 95+ | 90 |

Of course, projections can’t be guaranteed but from this analysis, they opted to aim to clear the mortgage by retirement rather than clearing the mortgage in full right now. What this meant in practice was we pulled a lump sum from super (to benefit from the tax-free uplift) and reduced their mortgage to a figure they could afford to clear by retirement whilst maintaining their existing repayments.

We continually review this with our client each year to make adjustments to stay on track due to market/interest rate changes.

3. Review investments to make sure they have an appropriate investment strategy tailored to their needs

Primarily we want an investment strategy to help manage the two key risks for someone that needs to live of an investment portfolio:

- Sequencing risk: which is a fancy way to say if the market drops significantly as you start drawing down on your portfolio, it may not last long enough to cover your needs.

- Longevity risk: which is the potential to outlive your money

The way to combat sequencing risk is the have defensive assets like cash and bonds so that you have minimal risk investment markets will cause a significant drop in your portfolio value. But the problem with that is it increases your longevity risk. And the solution to longevity risk in to increase your exposure to growth assets like shares and property so that you earn a high enough return for your money to grow enough that you won’t outlive it. But now that increases sequencing risk.

The way we help our clients strike the right balance is by using a ‘bucket’ approach. We make sure there is enough funds in defensive assets to manage their sequencing risk in the short-term while the rest of their funds can be invested in growth assets to reduce longevity risk. This is all done while taking into account their risk tolerance, investment preferences, and a focus on minimising their ongoing costs.

With the appropriate buckets in place, the defensive bucket will keep getting filled up by interest and dividend payments. But we can also opportunistically sell growth assets after very strong years or re-invest some of the cash into the growth assets when markets are down to maximise long-term returns.

Working with us

We only want to work with people where we are sure we can add significant value above our cost to provide advice. To that end, we offer an obligation-free initial consultation to ensure we’re a good fit to work together and we’re sure we can help. If we can’t, we’ll let the client know and they are no worse off.

Also important to keep in mind many TPD policies include a Financial Planning benefit that can generally cover most if not all our fee to review their situation and prepare a plan meaning there’s a good chance it won’t cost the client anything, the insurer will pay.

Disclaimer

Any advice is of a general nature and has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation, and needs. Please seek personal financial advice prior to acting on this information. This has been prepared and by Constellation Financial Planning Pty Ltd, a corporate authorised representative (CAR 1260791) of InterPrac Financial Planning Pty Ltd (AFSL 246638).