For most of us investing is relatively straight forward while we are building our wealth for retirement. However, as we approach retirement and are getting ready to live off the wealth we’ve built, what we’re invested in and how we’re invested become much more important.

As far as investments are concerned there are generally two key risks that need to be balanced as we approach retirement. These are:

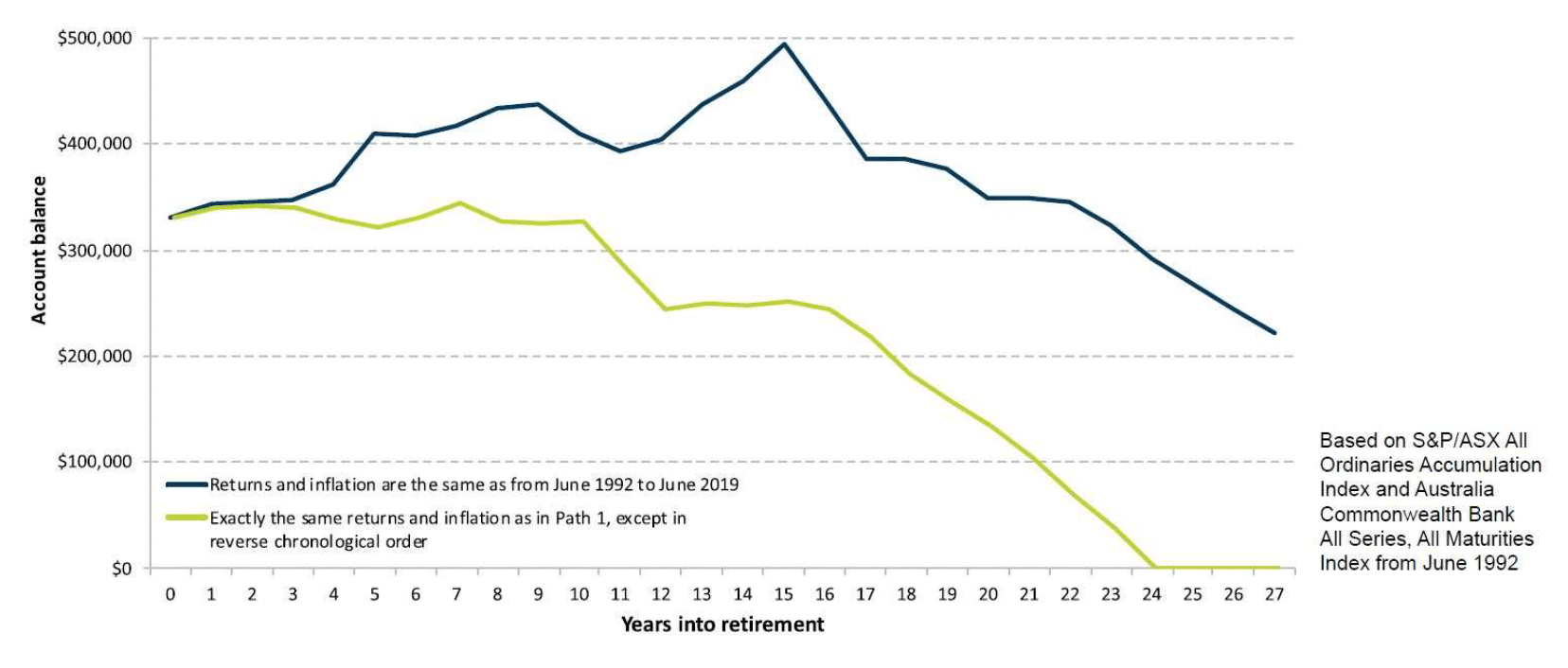

- Sequencing risk: which is a fancy way to say if the market drops significantly as you start drawing down on your portfolio, it may not last long enough to cover your needs.

- Longevity risk: which is the potential to outlive your money

The way to combat sequencing risk is the have defensive assets like cash and bonds so that you have minimal risk investment markets will cause a significant drop in your portfolio value.

The below graph illustrates sequencing risk by showing how even with the same average return, the timing of those returns can have a dramatic impact on how long your portfolio lasts.

Source: Challenger

The problem with reducing sequencing risk by investing in defensive assets like cash and fixed interest is it increases your longevity risk. And the solution to longevity risk is to increase your exposure to growth assets like shares and property so that you earn a high enough return for your money to grow enough that you won’t outlive it. But now that increases sequencing risk.

One way we help our clients strike the right balance in this conundrum is by using a ‘bucket’ approach. We make sure there is enough funds in defensive assets to meet income requirements over the short to medium term while the rest of their funds can be invested in growth assets to reduce longevity risk.

With the appropriate buckets in place, the defensive bucket will keep getting filled up by interest and dividend payments. But we can also opportunistically sell growth assets after very strong years or re-invest some of the cash into the growth assets when markets are down to maximise long-term returns.

Importantly, the above is only a start and holistic plan for funding retirement should also give consideration to maximising Centrelink entitlements and different products that can provide guaranteed income to ensure an optimal outcome is reached so that you can have confidence and clarity throughout your retirement.

General Advice Warning

Any advice is of a general nature and has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on the advice, consider the appropriateness of the advice, having regard to your objectives, financial situation, and needs. Please seek personal financial advice prior to acting on this information. Investment Performance: Past performance is not a reliable guide to future returns as future returns may differ from and be more or less volatile than past returns.